2024 Year In Review: Fintech in Israel

Part one of a series reviewing trends and activity in across various sectors within Israel's startup ecosystem

The following is a post about Israel’s fintech sector in 2024. This is the first of a series of annual reviews for various technology sectors, and to kick off the post I wrote a small general introduction.

It’s been a year.

There’s still a month to go, but 2024 has gone by both insultingly slow and painfully quick.

Despite the national challenges Israel has faced this year, the early stage startup ecosystem has experienced one of its most active years in recent memory. I wrote about this back in March and the blistering pace of activity persisted through the summer until the local holidays.

At TLV Partners 2024 has already been our most active year in terms of net new investments. At the time of this post we have led 10 new rounds of financing (eight seed rounds and two A rounds). Historically we’ve invested in an average of eight deals per year dating back to 2016.

This is notable because a narrative seems to exist that Israel’s high-tech ecosystem is suffering due to the ongoing conflict. Of course there have been challenges (reserve duty has disrupted countless founders’ and employees’ routine, business travel has slowed due to lack of flights and the emotional toll of the conflict affects everyone’s ability in one way or another), but despite the challenges the overall ecosystem has been thriving.

Companies have been growing quickly, investment rounds have been competitive and both local and global investors have been aggressively deploying capital at the early stages.

So as 2024 comes to a close I thought it would be interesting to review a few of the dominant sectors in our ecosystem and share some general observations, trends and opportunities relating to those sectors.

The sectors I plan to review are fintech, defense-tech, cyber security, and AI applications.

2024 Israel Fintech Review

Fintech Winter

Israel’s early stage fintech ecosystem left a lot to be desired during 2024.

While not necessarily representative of the entire ecosystem, fintech has historically (dating back to 2017) represented 15-20% of our new investments at TLV Partners each year. This year though, we did not make a single fintech investment and that comes during our most active year in terms of overall net new deals.

Not only did we not make a fintech investment in 2024, but we experienced a significant decrease in fintech deal flow.

Humor me and allow me project our lack of fintech investments during 2024 on the entire ecosystem - - - I believe there are two reasons driving this slowdown.

Investor Weariness - 2023 and 2024 (at least the first half) saw public fintech stocks tumble and a lot of noise around the difficult regulatory environment for fintechs. On the heels of peak fintech optimism in 2020 and 2021, perhaps investors were weary of funding new companies in that market climate

Founder Weariness - Both due to the difficult market climate and perceived/actual investor weariness, fewer founders decided to found companies in the sector*1

Spring is Here

I believe there are several reasons that investor and founder weariness will evolve into investor and founder enthusiasm during 2025.

Public Market Performance2 - public fintechs like Block, Affirm, Adyen, Robinhood and SoFi have been performing quite well over the past quarter+.

Additionally, it seems like fintechs will be one of the main winners of the eventual opening of the IPO floodgates. Stripe, Klarna, Revolut, Chime, and Plaid are just a few of the companies that are expected to go public over the next year or two. I expect them to have successful listings.

The Trump Administration - whether or not the Trump administration loosens the regulatory noose around fintechs’ necks remains to be seen. However the overwhelming sentiment is that the new administration will remove the noose altogether. This is something that the founders of Andreesen Howorwitz address in the video below.

AI x Fintech - Founders and investors alike have been, and continue to be, looking for any and every opportunity to create companies around using AI to increase efficiency in legacy businesses. Fintech was not the first sector that Israeli founders flocked to, but I’ve finally started to meet a wave of new companies looking to use LLMs in various realms of the fintech arena

Maturation of Alternative Payment Rails - After years and years of fintech companies being built on top of ACH or card networks (and either struggling to find a way to monetize ACH payments or pushing the limits on how much interchange can be carved out for themselves), it seems that we are on the precipice of large scale adoption of a few legitimate alternatives: FedNow and Stablecoins

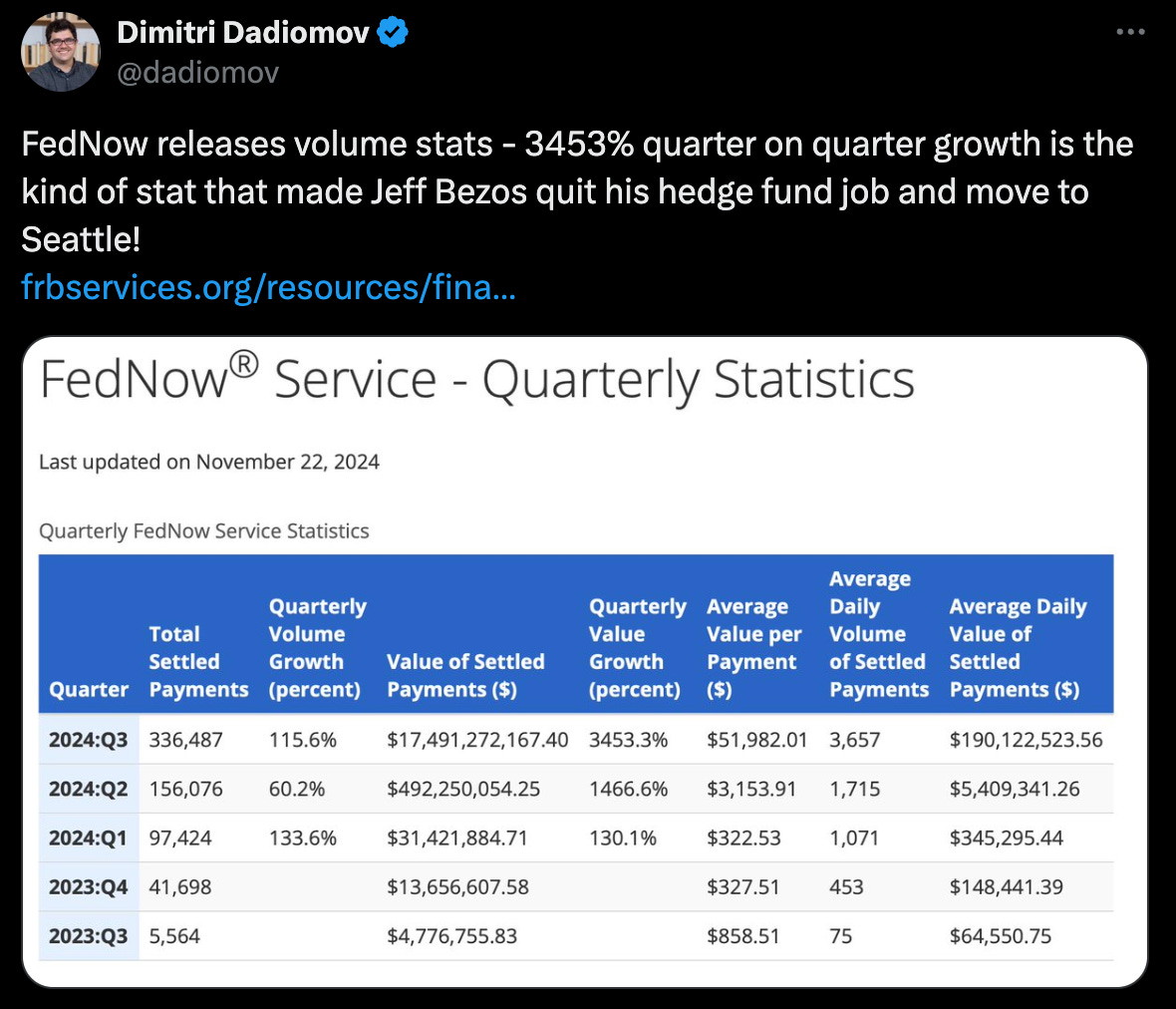

FedNow, which is a real time payments service developed by the Federal Reserve Bank seems to be gaining real momentum:

Stablecoins - Stripe announced a $1bn acquistion of Bridge in October. Stablecoins were already on their way to becoming the preferred currency of the internet, but with Stripe’s endorsement and rollout, it’s safe to assume that they will become ubiquitous.

Looking Forward

2024 was a forgettable year when it comes to fintech. There are several reasons for optimism looking forward though, and already during the end of Q3 and early Q4 I noticed an anecdotal uptick in the number of interesting fintech opportunities currently raising funds.

I expect that uptick to continue going forward as there are so many interesting opportunities in fintech at the moment. Whether it’s building new businesses and/or business models around real time payments, leveraging LLMs for financial data analysis, building AI native banking infrastructure, or transitioning the massive financial services industry into a services-as-a-software industry - there are a lot of potential companies I’m hoping to meet in the coming year.

I would be remiss if I didn’t mention that as an investor, I’m most interested in investing in founders who are passionate about building in fintech regardless of the macro environment. Trends ebb and flow, but true passion never dies.

Looking forward to a fintech filled 2025!

I met too many highly qualified fintech founders who decided to focus on cyber security during 2024. This will be addressed in the cyber security overview that I’ll publish in a few weeks

Public markets should theoretically be a lagging indicator of early stage activity. But I’ve found that the psychological element of being able to see what success looks like has a real impact on both funding and founding net new companies